Finally, a Disability Tax Credit Application that fills itself out!

Looking to Simplify the Process of Applying for the Disability Tax Credit?

We have designed a way for Canadians and medical practitioners to fill out the most disliked form.

Without having to fill out that form.

How it works

The process is simple so you don't have to worry about anything

Assessment

We start with a few questions to determine which activities of daily living you struggle with and the level of severity to determine if you are likely to qualify.

Custom Online Application

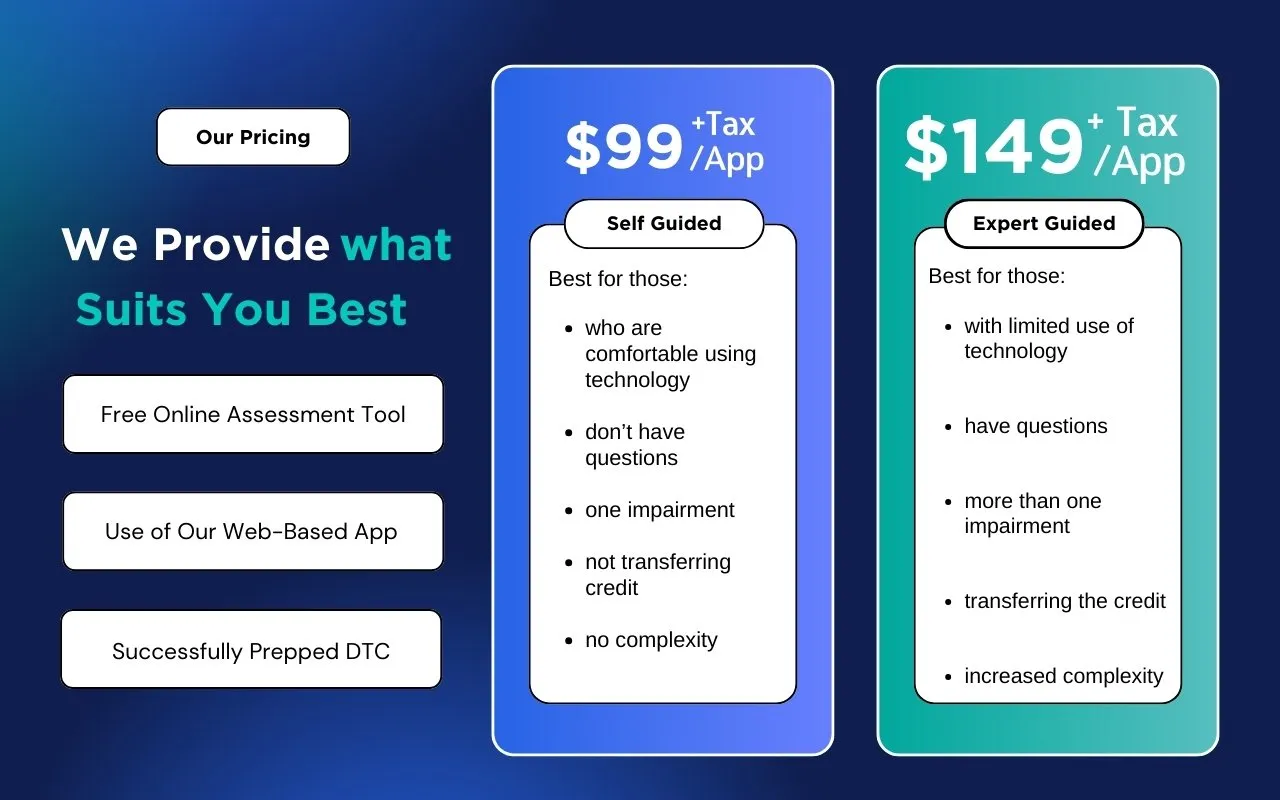

You choose your application method. You can use our simpler application method to prepare your own application or book a guided application with a consultant.

Review & Certify

Print your application and take it to your medical practitioner or engage one of our DisabilityDocs to review your medical records and sign your application.

No Doctor? No Problem!

During the application process we ask you if you have a medical practitioner who has agreed to review and certify your application. If you choose no, we will provide you with information in an email to engage a DisabilityDoc to review your medical records and sign your application provided you meet the criteria.

Please note that medical practitioners may also charge a fee to review and certify your application, answer any additional requests for information from the Canada Revenue Agency and maintain your medical records based on your age at the time of applying.

What Sets Us Apart

We are NOT a Disability Tax Credit Promoter Company

We advocate for Canadians who qualify for the Disability Tax Credit and their Medical Practitioners

We Simplify Disability Tax Credit Preparation for a Higher Degree of Success

Experience

A seasoned team of experts each with over 20 years of experience

Credibility

Designed by a family doctor and other medical, legal, financial and technology experts

Flat Fees Only

We operate under the Disability Tax Credit Promoter Restrictions Act which came into force on Nov 15, 2021 but is tied up in court proceedings so that we can leave more money in the hands of the person with the disability and their supporting family members

Collaboration

We collaborate with wealth management, legal and accounting firms and charities that support Canadians with disabilities

Diversity & Inclusion

We are an inclusive workplace that encourages those with disabilities to apply for job openings and we seek to help them save more effectively for their retirement

Social Impact

We are on a mission to help bridge the digital divide by assisting charities that are helping low income populations gain access to the web through the necessary hardware, internet services, etc.

Stay Informed and Empowered

Welcome to the Benefits2 Event Calendar!

We understand that navigating the Disability Tax Credit can be complex, and we're here to empower Canadians like you with knowledge and support

Explore our calendar to find a lineup of informative and interactive events designed to help you make the most of this essential financial benefit

Meet Our Team

We are professional advisors

ready to help you

About our company

Our company is head-quartered in Burlington, Ontario and we service clients all over Canada. Since 2023, we have helped more than 1,600 people apply and be approved for the Disability Tax Credit.

If you are a wealth management company, legal or accounting firm or a charity and you would like to collaborate to help more Canadians with disabilities that qualify to successfully apply for the Disability Tax Credit, let's talk!

Prescription for Change &

Social Impact

© 2024 Benefits2. All Rights Reserved.