Simple, Streamlined Disability Tax Credit

Effortlessly Prepare Your Disability Tax Credit Application With the Support Level You Choose

How it works

Guiding You Every Step of the Way

Get Ready to Apply

Decide if your medical practitioner will support your application. If not, we do provide access to one through AbilityDocs. You will need to ensure you have access to your medical records that support your impairment.

Choose Your Level of Support

Complete an online assessment, set up your account, and choose your support level. We offer do-it-yourself and guided application options. You can choose your consultant and the timing that works best for you.

Complete Application

Answer simple questions related to your impairment(s). It typically takes about 45 minutes. Once completed, your DTC will be generated to print and take to a qualified medical practitioner to review and sign.

Assessment

Should I Apply?

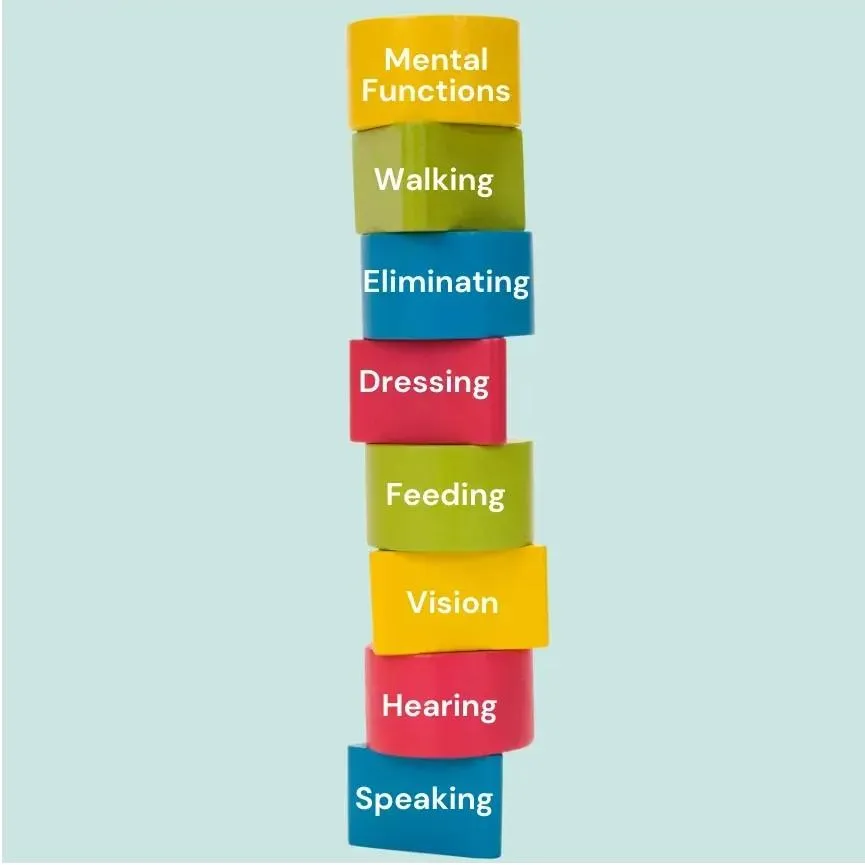

Click on an image to learn more about eligibility for each impairment

VISION

SPEAKING

HEARING

WALKING

ELIMINATING

FEEDING

DRESSING

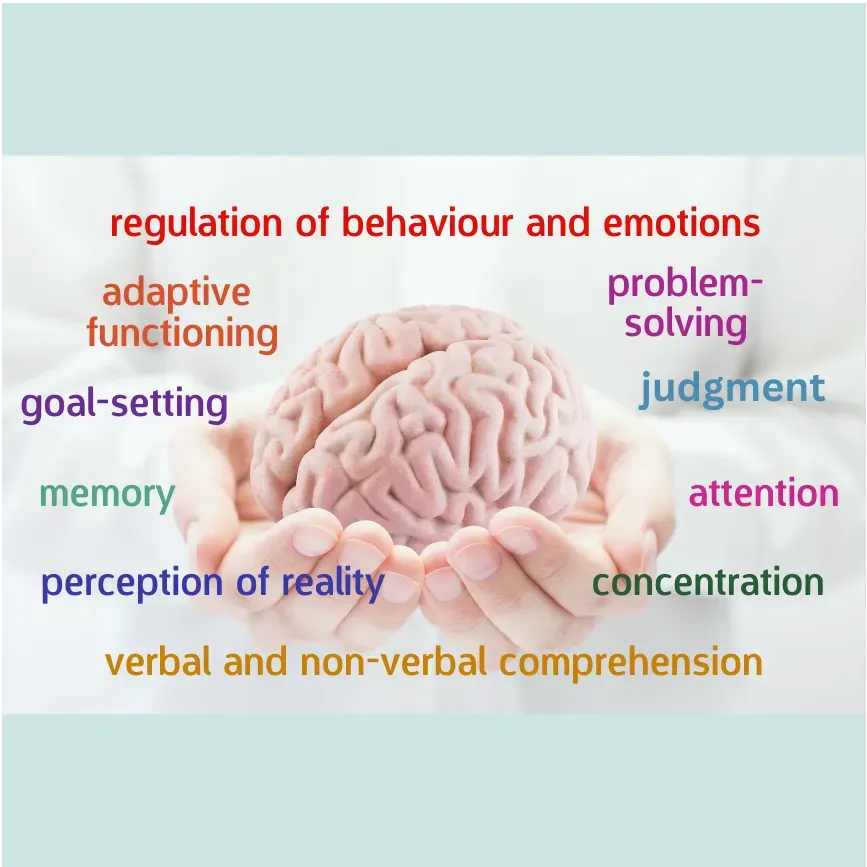

MENTAL FUNCTIONS

CUMULATIVE EFFECTS

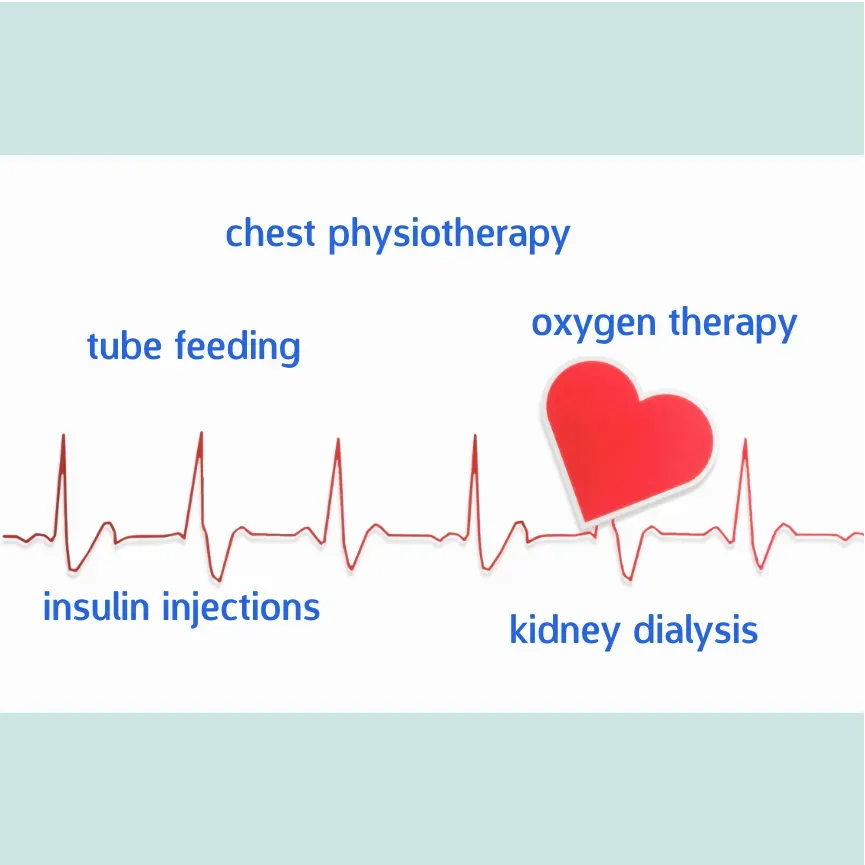

LIFE-SUSTAINING THERAPY

Take Our Quick 2-Minute Assessment to See If You Qualify

Pricing

Pricing that fits your needs

Transparent, flat-fee pricing—no hidden costs, just clear options to suit the level of support you need

SELF NAVIGATE

$99

Plus applicable taxes

Use our Easy-to-Use Application Tool

Requires some knowledge of the Disability Tax Credit

Complete your application independently

Best for those confident in their understanding of the process

CONSULTANT NAVIGATED

$149

Plus applicable taxes

Use our Easy-to-Use Application Tool

No prior knowledge required—consultant provides expertise

Consultant reviews your application for accuracy

Best for those seeking personalized assistance and extra peace of mind

Medical Practitioner Assistance

No Doctor? No Problem!

During the application process we ask you if you have a medical practitioner who has agreed to review and certify your application. If you choose no, we will provide you with information in an email to engage an AbilityDoc to review your medical records and sign your application provided you meet the criteria.

Please note that all medical practitioners may also charge a fee to review and certify your application, answer any additional requests for information from the Canada Revenue Agency and maintain your medical records.

Our Promise

What Sets Us Apart

Experience

A seasoned team of experts each with over 20 years of experience

Credibility

Designed by a family doctor and other medical, legal, financial and technology experts

Flat Fees Only

We offer an option that is in line with the Disability Tax Credit Promoter Restrictions Act which came into force on Nov 15, 2021 but is tied up in court proceedings so that we can leave more money in the hands of the person with the disability and their supporting family members

Collaboration

We collaborate with wealth management, legal and accounting firms and charities that support Canadians with disabilities

Diversity & Inclusion

We are an inclusive workplace that encourages those with disabilities to apply for job openings and we seek to help them save more effectively for their retirement

Social Impact

We are on a mission to help bridge the digital divide by assisting charities that are helping low income populations gain access to the web through the necessary hardware, internet services, etc.

Our Foundation

The Core of Our Purpose

Our Mission

Simplifying disability support for Canadians

To empower Canadians with disabilities by simplifying the path to accessing the Disability Tax Credit and advocating for support.

Our Vision

Empowerment through access

A Canada where every eligible individual easily secures their Disability Tax Credit and advocating for equitable support.

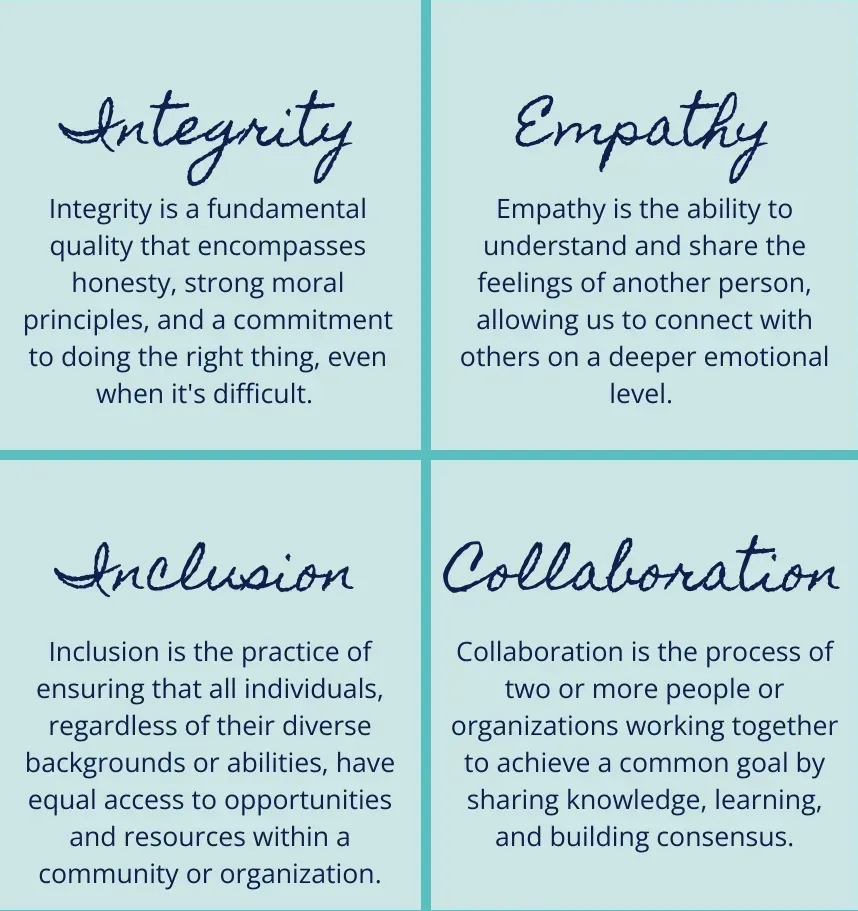

Our Values

Guiding Principles

Integrity: Transparent, flat-fee pricing with no hidden costs

Empathy: Advocating for individuals and their medical practitioners

Inclusion: Embracing diversity and ensuring accessibility for all

Collaboration: Working together for greater impact

Innovating For Change

Using Technology to Amplify Our Impact

Through our not-for-profit entity, AppAbility, we license our proprietary software to other organizations.

This subscription model empowers more organizations to leverage innovative technology, amplifying their impact within their communities.

Stay Informed and Empowered

Welcome to the Benefits2 Event Calendar!

We understand that navigating the Disability Tax Credit can be complex, and we're here to empower Canadians like you with knowledge and support

Explore our calendar to find a lineup of informative and interactive events designed to help you make the most of this essential financial benefit

Upcoming Events

Sorry, no events right now. But really cool stuff is coming up soon.

Customer Support

Not ready to apply yet?

Give us a call

Have questions or need assistance? Give us a call, and our friendly team will provide personalized support to guide you through the process.

Gather free resources and ask questions

Prefer to connect online? Join our Facebook Group to access valuable resources, engage with our community, and ask questions—anonymously if you choose—to maintain your privacy.

Frequently Asked Questions

Before Applying

What is the Disability Tax Credit?

The Disability Tax Credit (DTC) is a non-refundable tax credit designed to help individuals with disabilities, or their supporting family members, reduce the amount of income tax they may have to pay. The goal of the DTC is to offset some of the extra costs associated with living with a disability.

Do I need a formal diagnosis to apply for the disability tax credit?

No, you don't need a formal medical diagnosis to complete the Disability Tax Credit Application on our website. However, we recommend talking to your medical practitioner about your condition to gather all the relevant information before starting your application. Collecting medical information from hospitals, clinics, and specialists can take some time.

What if I do not have a family doctor or one willing to sign my disability tax credit application?

We can help recommend a medical practitioner to review and potentially sign your application. If you need assistance, please contact us at [email protected]. Medical practitioners will need all relevant medical documentation to support your impairment, so please have all the necessary documents ready when we connect you with a practitioner.

I want to use your website to apply for the disability tax credit, but I am nervous about using your website and not understanding the questions or which answers are appropriate for me?

Don't worry. We offer a guided application from a trained DTC Navigator who will be with you from the beginning to the end of your application.

During Application

I chose the self-guided option and now I would like additional assistance?

If you would like to upgrade, reach out to us at [email protected] or give us a call toll-free at 1-877-257-7725 and we will be happy to assist you with upgrading.

How do I get in contact with a medical practitioner to review and sign my application and what does it cost?

Visit the AbilityDocs website at https://abilitydocs.ca. Their services and fees are clearly described along with instructions on reaching out to them

My family doctor does not agree with some of the comments in my Benefits2 disability tax credit application. How can they make ?

When you create/ download your DTC Application on our website you are provided a “code” that is emailed to you that you can bring to your appointment with your medical practitioner. During sign-up of your account on our website you are asked for your mobile number and when you provide this “code” to the medical practitioner you will be sent a second security secure code (2-Factor Authentication) to your mobile phone which the medical doctor can then enter on our website to proceed to access your application and then edit information and later print off and sign. The medical practitioner can access your application by visiting our website www.dtc.benefits2.ca and choosing the “Physician Access” button in the top right corner of our website.

How do I submit my application to the Canada Revenue Agency??

Log in to your CRA account and …

1. Click on Submit Documents.

2. Click “Start”.

3. Select “No”.

4. Under “Topics” Select “Benefits and Credits”.

5. Select “Send Form T2201, Disability Tax Credit Application, or send supporting documents”.

6. Click “Next”.

7. Click “Upload file(s)” and then “Browse” then attach your application or supporting documents that you saved to your computer.

8. In the description box enter your name and DTC application i.e. “Jane Doe DTC application” and click “Attach file(s)”.

9. Click “Next”.

10. Review to make sure you have the proper attachment.

11. Click “Submit”.

12. Print the confirmation page.

Been Approved

I need assistance with tax adjustments. Are you able to provide guidance or assistance with the next steps?

We have partnerships with accountants who are well-versed in processing adjustments and ensuring you are maximizing your benefits and credits. We can provide an online form to fill out to have them review your specific case. They provide flat rate fees that are in line with the recommendations under the Disability Tax Credit Promoters Restrictions Act. Exceptions may apply if you have a complex tax situation.

I am interested in setting up a Registered Disability Savings Plan. Do you provide assistance with this?

If you do not have an advisor who can assist in opening an RDSP for you, please contact us at [email protected] and we will be happy to provide you with resources to find an advisor who specializes in RDSP’s. We recommend speaking with financial advisors who have experience working with RDSP’s with other clients and understand financial planning in this area.

Been Denied

CRA has denied my disability tax credit application. Are you able to provide guidance on next steps?

We are currently formalizing a process to handle denials. If you have been denied, reach out to [email protected] and we would be happy to discuss your case.

I have been previously denied by CRA after applying for the disability tax credit. Can I use your website to apply again?

In many cases we encourage those previously denied to reapply after a period of at least 3-4 months. You can definitely use our website to reapply; however, please get in touch with us at [email protected] before proceeding.

Tech Support

I am getting an error code when signing up?

Sometimes it is a browser issue. Depending upon which browser you using, we recommend trying an alternate browser such as Microsoft Edge or Google Chrome.

Our Team

Our team is a dedicated group of experts passionate about empowering Canadians to access the Disability Tax Credit. With years of experience, we combine knowledge, compassion, and innovation to simplify the process and provide personalized support. We’re committed to advocacy, collaboration, and making a meaningful social impact, ensuring every individual feels seen, heard, and supported.

Christine Brunsden

Co-Founder, CEO

Christine is a professional estate, trust, elder planning and philanthropic advisor with more than twenty five years of experience in the trust and estate industry and a lifetime of experience with family members with disabilities.

Dr. Wayne MacLeod

Co-Founder, CMO

Wayne is a family physician with an interest in helping Canadians with disabilities apply for the Disability Tax Credit. He started offering assistance because of the number of barriers and needless complications people faced while trying to access it.

Geoff Parsons

CISO

Geoff is a cybersecurity and data privacy professional with an interest in making the Disability Tax Credit more accessible for Canadians and their families due to his own experiences with promoter companies who charged a percentage of refunds.

About us

Benefits2 is head-quartered in Burlington, Ontario and we service clients all over Canada. Since 2023, we have helped thousands of people apply and be approved for the Disability Tax Credit.

If you are a wealth management company, legal or accounting firm, a union or human resources department and you would like to collaborate to help more Canadians with disabilities that qualify to successfully apply for the Disability Tax Credit, let's talk!

Apply for the Disability Tax Credit today

Start your journey to claim the benefits and support you deserve and unlock other benefits and credits.

Did you know?

Benefits2 does not provide health, legal, accounting or financial advice.